Introducing Irwin + FactSet Event Broadcast: Connecting Corporates and Investors

Discover Event Broadcast, the game-changing feature from Irwin and FactSet that connects corporates with investors.

Discover and connect with investors. Monitor shareholder changes. Track every interaction with ease. With automated features and proactive insights, Irwin saves you time to focus on what matters most—deepening relationships across the capital markets community.

Irwin allows you to better manage your IR program by automating manual tasks, giving you access to powerful, differentiated investor and shareholder data, and reducing your time to insight so IR teams can focus on adding strategic value to their company.

Access an extensive database of institutional, hedge fund, and family office investors and filter to find the right investors for your company.

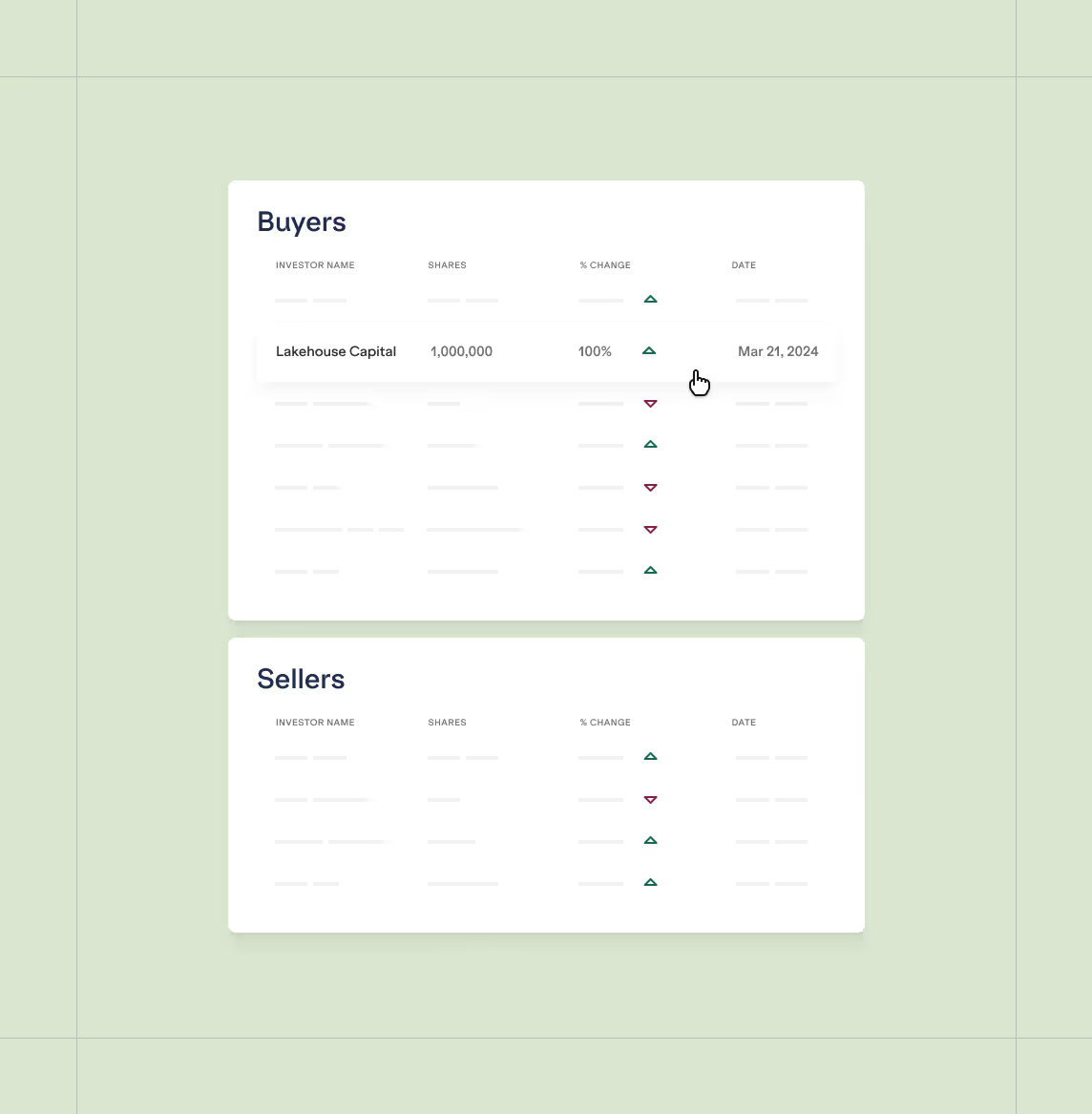

Comprehensive monitoring with reported, retail, and non-reporting, surveillance, and custom holder data.

Keep track of all your investor interactions, manage events & roadshows, and report on the success of your program.

Access an extensive database of institutional, hedge fund, and family office investors and filter to find the right investors for your company.

Add bench strength to your IR team for analyst and investor targeting, board reporting, and market insights.

Streamline your investor relations program with fully-integrated market analytics & CRM tools.

Say goodbye to clunky & outdated systems.

All your most important data in one place.

Reduced-time to insight and automation built-in.

Award-winning service to support your IR program.

Irwin allows you to better manage your IR program by automating manual tasks, giving you access to powerful, differentiated investor and shareholder data, and reducing your time to insight so IR teams can focus on adding strategic value to their company.

Get transparency and insight into your shareholder base with Irwin's comprehensive suite of shareholder monitoring solutions. Reporting filings, NOBO data, stock surveillance, custom holders, and intuitive reporting allow you to maintain relationships and communicate regularly with key shareholders.

Target the right investors for your company with Irwin's precision investor targeting solution. Access our comprehensive database of institutional, hedge fund, and family office investors, then conduct outreach directly from the Irwin platform.

.avif)

Irwin's award-winning CRM solution is purpose-built for IR teams. Our platform centralizes your investor interactions, streamlines reporting, and simplifies event management—freeing you to focus on what matters most: deepening connections across the capital markets community.

Strengthen your investor relations strategy with Irwin IQ, our cutting-edge website visitor and content intelligence tool. Gain valuable insights into which investors and peer companies are engaging with your IR website, and understand which content drives the most impact. Irwin IQ seamlessly integrates with our comprehensive suite of IR tools, empowering you to make data-driven decisions and focus on building meaningful relationships.

.avif)

An end-to-end platform that seamlessly integrates Irwin's powerful CRM with FactSet's market-leading financial data, analysis, and research. This strategic integration empowers IR teams with the most comprehensive capital markets insights and data, all in one place.

Discover Event Broadcast, the game-changing feature from Irwin and FactSet that connects corporates with investors.

FactSet and Irwin have partnered to deliver a best-in-class investor relations solution. Learn more.

Investor targeting is a crucial aspect of any IR strategy. Discover how to master the art and science of investor targeting with Irwin.

Across geographies and market caps, one theme is consistent: IR is entering a period of recalibration. Learn what's changing in 2026.

Discover the key frameworks and techniques to structure your message, adapt to your audience, and leverage modern comms effectively for IR.

.avif)

Irwin’s 2025 State of IR Report reveals how IR professionals are adapting to AI, investor targeting, and evolving shareholder relationships.